The energy crisis has the industry in an uproar

Published on 2 November 2022

Maison&Objet Barometer #5. 97%, in other words, nearly all the professionals surveyed have stated that they’re being impacted by rising energy prices. Beyond this simple observation, the latest Maison&Objet Barometer highlights the solutions that industry stakeholders are providing to this challenge.

For its barometer, Maison&Objet surveys industry stakeholders three times a year on market indicators or subjects of current interest. This data is based on the results of an online questionnaire conducted from October 3rd to 12th, 2022 of 810 Brands, Retailers, or Specifiers.

Everyone is being affected

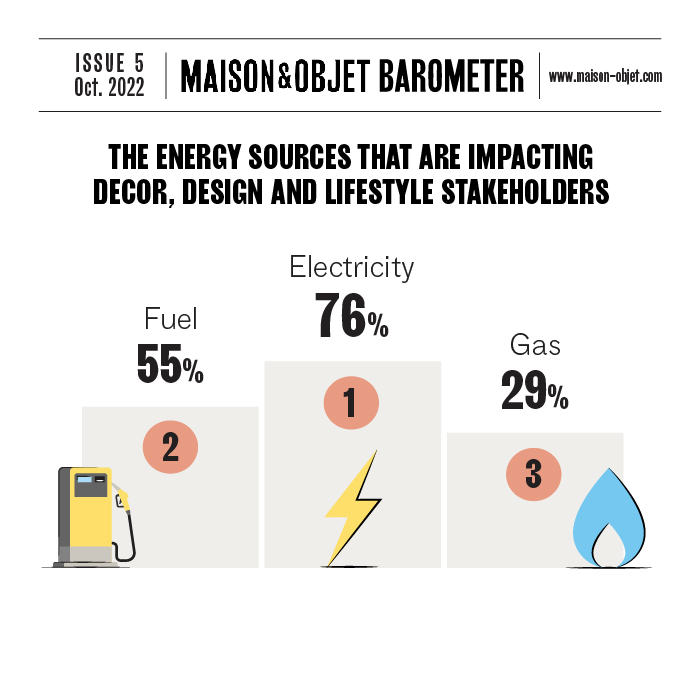

No business is being spared. Retailers, specifiers, and brands all say that they’re being “strongly impacted”, for 45%, 38%, and 42% of them, respectively. Electricity, oil and its by-products, gasoline and diesel fuel, and finally, gas, are the energy sources they say they depend on, for the most part. These are also the ones that have seen the most significant cost increases.

“Customers’ morale is low”, says one brand. Customers affected by the significant increase in energy spending as part of their budget are looking carefully before buying. “And they’re moving around less”, adds a retailer. “A large part of my customers are Parisians who own vacation homes. I’m expecting less traffic this winter…because they’re trying to avoid having to heat these houses”, expects one French boutique.

83% of resellers are noticing changes in their clients’ purchasing behavior due to these new economic circumstances. For 47% of them, this means a lower average purchasing basket. 40% of them are seeing an increase in the number of clients who come to the shop but don’t buy anything, with one possible insight on an explanation: they believe that 43% of clients are taking the time to comparison shop.

75% of specifiers who participated in the survey have also noted changes in the behavior of their clients or prospects. They mention the impact of increases on “project execution costs” and on “the cost of construction materials and supplies”. 68% of them highlight reduced project budgets and 63% note that decision times are getting longer. “Potential clients (…) have design needs but are skimping on project execution and materials. Even the wealthiest clients are becoming more careful, and supplier prices are increasingly inconsistent considering the quality offered”, comments an interior designer. “It’s hard to maintain an atmosphere of trust. Even without increasing our prices, the total project cost is becoming a real obstacle to exercising our profession”. ”The most delicate aspect is managing budgetary uncertainty, along with unstable decision-making by project owners. They’re increasingly doing the plans, sketches, and construction work themselves…”, says another professional with alarm.

Everyone is taking action

68% of companies surveyed say that they have taken measures to minimize the impact of the energy crisis. Should we put the thermostat at 17, 18, or 19 degrees? It’s no longer a matter of knowing if we should reduce heating consumption, but rather by how many degrees. Each firm is adapting this to its specific circumstances. “We won’t experience a ‘heating crisis’ but we may very well have an air-conditioning one…”, notes a firm located in Southern Africa, wryly.

In terms of lighting, in cases when it hadn’t already been done, LEDs seem to have replaced traditional light bulbs everywhere. Then came temperature controllers, light programming, improved insulation…The full range of systems and equipment that allow firms to reduce expenditures is being used. With sometimes major investments underway or planned: “Changing 16 workshop windows and a skylight on the roof, installing a heat pump” for one wholesaler, or a solar panel installation project for others.

For brands with a shopfront, the lighting of shop windows and opening hours are other subjects of discussion. “I’m in a shopping mall, and closing at 8 p.m. is pointless since there’s no foot traffic after 7 p.m. Closing an hour earlier a day will allow us to make major energy savings”, suggests one shop manager. “I’m not planning to put any decorative lighting up for Christmas this year in our shop window”, another retailer has announced.

More anecdotal, yet nevertheless effective, the availability of “thermolactyl garments” or “sweatshirts” for their teams, or even the designation of a “money-saving manager”, have been implemented by companies.

Ready to adapt

Working and manufacturing methods or habits are also being adjusted.

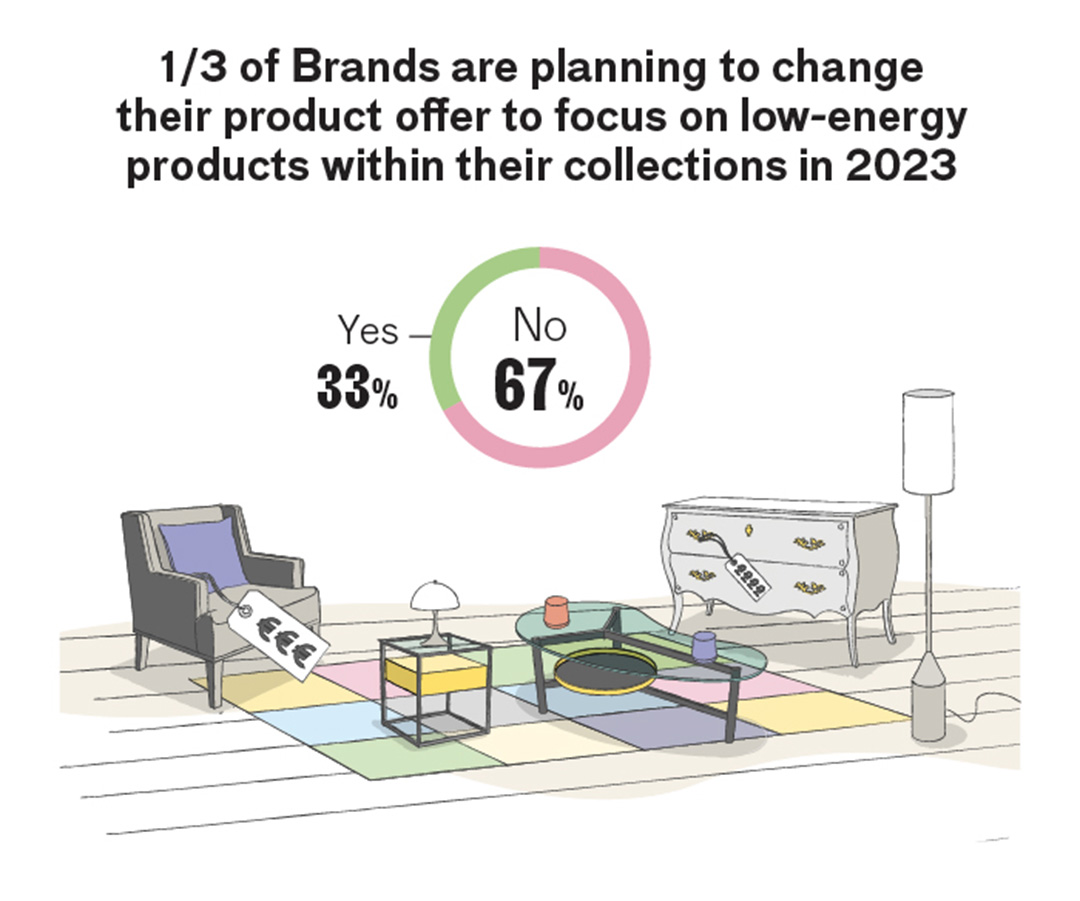

Among brands, for example, 41% of them say that they’ve been forced to manufacture to order, and 36% are optimizing the loading of merchandise shipping. And finally, 17% of them have revisited the working hours of their manufacturing teams, and 6% declare that they’ve stopped production lines that consume too much energy.

Solutions are emerging from all industry stakeholders, who are re-examining their business operations or planning. “We’re reorganizing our delivery routes”, says one reseller. “I’m planning my schedule differently. I stay in cafés when I have meetings in the morning and late in the afternoon, which means I can avoid round-trips in my car”, an American interior designer tells us, “And I do more Zoom calls whenever I can”. Optimizing travel and grouping together orders also appear frequently in survey comments. “I try my best to group purchases in one go. But it isn’t always easy to do that”, confides a French retailer. This new context has reaffirmed the usefulness for industry professionals of a fair such as Maison&Objet, which allows them to concentrate all their meetings, their search for new products, and placing orders into one event.

Raising retail prices and rates is, of course, another possible solution to compensate for part of the skyrocketing energy costs. On this point, views are still mixed. It has been or is being considered by 53% of retailers, 52% of specifiers, and 61% of brands that answered the survey, with concern about falling sales volume for 9 out of 10 industry professionals. For many of them, the weeks and months to come will force them to take a firmer position on the subject.

In the meantime, one positive aspect of this gloomy period may be this forced reduction in energy consumption, travel, and shipping, which some professionals have already experienced.

“From energy savings to recycling, we’ve been working with our factories. Everything we’re involved with (our materials, products, and even initiatives with our partners…) must be sustainable, natural, organic, recycled, and recyclable. Taking the right measures to prepare for greener manufacturing has opened up new possibilities for us”, states an American brand.

By hastening a movement toward more “virtuous” practices for the environment, this crisis is sharpening the responsiveness of industry stakeholders, encouraging them to design new ways to make things, get organized, and work, and may also generate some beneficial effects in the long term.

Discover the infographic, which reflects the major indicators of the Barometer.

MORE IN-DEPTH INVESTIGATIONS:

An industry stakeholder faces the energy crisis

Daniel Talens, CEO of the ALESSI brand, explains to journalist Olivier Waché how he has faced the challenge of rising energy prices. These are lessons learned that all industry stakeholders will understand.

Available by subscription

Duration: 28 minutes

Maison&Objet Academy helps you understand the market and trends and how to make the right choices for your business. In the face of raw-material and energy price inflation, everyone has their own strategy. Brands, retailers and specifiers have learned to play around with the numbers, but most find themselves forced to pass on price increases, at least partially.

Watch on Maison&Objet Academy