Planning ahead to stand strong

Published on 2 June 2025

The Maison&Objet Barometer #10. Maison&Objet once again assesses the state of the international decor, design, and lifestyle industry. Nearly 1,200 retailers, specifiers, and brands have analyzed their business, revealed the challenges they face within an unstable international environment, and shared their perspectives, resulting in the April edition of our long-standing barometer of the profession. Here are some of the details.

For this first barometer of the year, 1,183 retailers, specifiers, and brands answered Maison&Objet’s call. Exceptional circumstances require extraordinary measures: due to the multitude of announcements from U.S. President Donald Trump, particularly of American tariffs being placed on products from dozens of countries all over the world, decor, design, and lifestyle professionals were surveyed two times. First, from mid-March to early April, before Donald Trump’s first announcements, and then in late April.

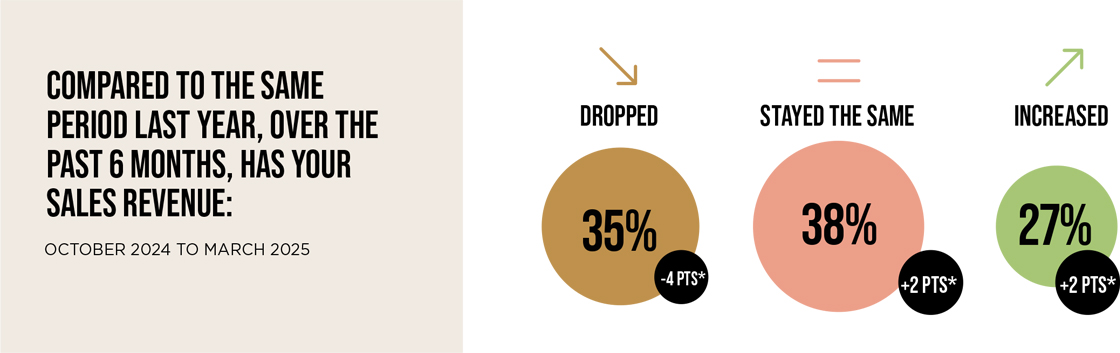

Firstly, between October 2024 and March 2025, 65% of respondents across all categories reported sales figures equal to or even higher than those of the previous year (for 27% of them).

In terms of geographic location, however, not all stakeholders are in the same situation.

69% of those surveyed based in North and South America managed to maintain or grow their sales over the past six months.

In the Asia-Pacific region, the figure was 81% of respondents.

Meanwhile, in Europe, the market is holding up rather well, even if the picture is more nuanced depending on the country. 63% of European industry professionals reported similar or higher sales compared to last year at the same time.

A divided residential market…

Among specifiers, space planning/design professionals, an average of five new projects have been signed up per firm between October and April. This is admittedly one project less than last year, but it’s better than in 2022 or 2023. In terms of the details, industry professionals specializing in residential projects have, for the most part (69%), stated that they have as many or more projects than they did over the previous period. Momentum has been greater outside of France, with 39% of non-French respondents to the barometer saying that they had undertaken more projects than last year, compared to 25% of French specifiers. The French residential market is still struggling to make a comeback. “It’s a difficult time. Clients have smaller budgets, so it’s harder to be contacted by and sign up a client”, a French architect confirmed to Maison&Objet. Investments in classic residential projects for the first quarter of 2025 (504 M€) declined by 40% compared to the previous year, according to international real estate firm Cushman Wakefield(1). Nevertheless, French professionals are keeping a positive attitude. Falling interest rates, increased demand for bank loans, and a drop in property prices may foster a rebound in real estate markets.

…And a recharged hospitality market

Hospitality projects seem to be rebounding. This April, 28% of professionals stated that they had undertaken a greater number of hotel projects between October and March, compared to 17% of them in April 2024. This growth has been spurred on an international level by luxury hospitality, in particular, which overperformed other categories in 2024 and is expected to do so again this year. This market should reach 166.4 billion dollars this year, compared to 154.3 billion dollars last year, buoyed by trends such as eco-luxury, museum-like hotels, and experiential luxury(2).

In terms of the restaurant business, 53% of specifiers surveyed by the barometer reported that they had the same or an even greater number of projects underway this year. Year-on-year, this represents a 13% jump.

While specifier work on shops and retail spaces is picking up, projects dealing with offices and workspaces are not experiencing the same positive momentum. In Europe, “the market is facing an uncertain political and social environment in some countries and a prudent attitude prevails among investors in this asset class”, according to Argie Taylor, Head of the International Investment Group at BNP Paribas Real Estate(3). So, the watchword is prudence, but not hesitancy: their investments in European commercial real estate have grown by 21% year-on-year, at the end of 2024.

Fresh energy in retail

Despite an economic situation that remains tense, with inflation continuing to weigh on consumer spending and, ultimately, traffic in brick-and-mortar shops, retailers are hanging in there. Though the majority of specialized retailers of furnishings or connected items have experienced lower sales over the past six months, as compared to the same period last year, others have seen increased sales volume: 28% of retailers in giftware and 30% in kitchenware and gourmet products. And this goes up to a third of them in fashion and accessories. Furthermore, on the French side, the situation has been confirmed through the words of the President of the Alliance du commerce (Retail Alliance), which includes 150 ready-to-wear and shoe brand stores and department stores. Bertrand Cherqui declared in late January, during the customary press conference outlining last year’s results, that 2024 concluded a decade of crises and decline in fashion retail, which, in his words, “finally picked up last year and regained some form of balance thanks to the agility of our firms, despite a challenging economic environment” (4).

In addition, the majority of retailers who participated in the Maison&Objet survey (57%) considered their current level of inventory to be “normal”. In terms of this inventory, they added an average of five new brands to their roster between October and March. 95% of retailers plan to place orders over the next six months. And a bit more than half of these (56%) are planning for the same, or even higher, level of orders than they placed last year.

And that’s good news. Because 89% of brands in the Maison&Objet community are preparing to launch new products from now through the end of the year. Compared to last year, they now manage their inventories with greater agility: 65% of professionals reported “normal” inventory levels. This percentage was 54% of them in April 2024. “After a disappointing 2023-2024, this year has started quite positively”, according to an English design studio. They have confirmed that “all our indicators are up, with much more optimistic prospects. 2025 promises to be a good year for growth and change.”

Looking ahead

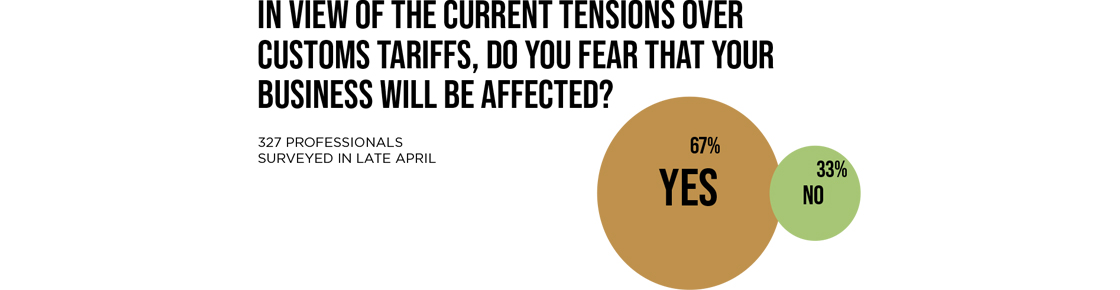

What can we expect through the rest of the year? Though economic uncertainty and instability remain all over the world, the Maison&Objet community does not intend to let it get to them. After showing definite resilience in the post-pandemic period, they plan to be more proactive and act early in the future. This stance may allow many stakeholders in decor, design, and lifestyle to hold firm in case of any sustained trade wars. In April, 67% of them estimated that Donald Trump’s announcements would have repercussions on their business. According to the statements we’ve collected, some of them are therefore planning to increase prices, and others, reduce their investments, or even seek out new, non-U.S. suppliers.

Between late March and early April, 83% of the 1,183 respondents mentioned a positive or neutral sales outlook for the next six months. As of late April, after the Trump announcements, 79% of them said that they had a positive or neutral outlook, among those who shared their views once again with Maison&Objet. “We’re quite concerned”, admitted an American retailer. They continued, saying, “But we’ve also seen how [Donald] Trump does a U-turn in his decision-making. Nothing is ever sure,” they said. “We prefer to adopt a positive attitude. Retailers are resilient.”

Article references:

(1) CUSHMAN & WAKEFIELD – May 2025.

Bilan du marché immobilier d'investissement résidentiel au premier trimestre 2025 : un démarrage plus modéré (A review of the investment-oriented residential real estate market in the first quarter of 2025: a more moderate start)

https://www.cushmanwakefield.com/fr-fr/france/insights/france-marketbeat-residential#:~:text=Le%20march%C3%A9%20de%20l'investissement,et%20des%20rendements%20en%20baisse.

(2) LUXURY HOTEL SCHOOL PARIS – May 6, 2025

Hôtellerie de luxe : croissance soutenue, dynamique record et ambitions XXL en 2025 (Luxury hotels: sustained growth, record momentum, and oversized ambitions in 2025)

https://www.luxuryhotelschool.fr/2025/05/06/hotellerie-de-luxe-croissance-soutenue-dynamique-record-et-ambitions-xxl-en-2025/

(3) LES ONDES DE L’IMMO – February 26, 2025

Consolidation des marchés utilisateurs et investisseurs (A consolidation of user and investor markets)

https://ondesdelimmo.com/marche-immobilier/international/bureaux-en-europe-le-point-sur-les-marches-utilisateurs-et-investisseurs

(4) LES ECHOS – January 29, 2025

Après dix ans de tempête, le commerce de l'habillement relève la tête en France (After a tempestuous decade, apparel retail starts to recover in France)

An exclusive report

To mark the publication of Maison&Objet's April 2025 Barometer, discover our exclusive analysis:

50 unprecedented pages of annotated data, expert analysis, geographic focuses, and feedback from international professionals.

Interior designers, concept stores, e-commerce stakeholders, design studios, and more: a variety of profiles shared with us their current state of business, prospects for 2025, and vision of the marketplace.